We hope everyone had a fun, safe, and perhaps even affordable, Fourth of July weekend. It was certainly tougher keeping a lid on the grocery bill this time around, and the average cookout cost 17% more than a year ago. But we still managed smoked tri-tip and prepared every BBQ-friendly side dish imaginable, even if it took a hit on the wallet.

This weekend was a nice recharge and helped us reflect on the current state of affairs as we crossed the halfway mark of 2022. Now seems like a good time to look back at where we were and the direction we might be headed.

Current Market Outlook

The Federal Reserve (Fed) recently reaffirmed its commitment to price stability with an accelerated schedule of interest rate hikes, but they will need to venture much further before we begin to see noticeable relief from higher consumer prices. After the Fed printed nearly $5 trillion during the Covid pandemic, it will take time before these deflationary forces impact consumer prices. In our best-case scenario, we imagine prices remain elevated in the short term as the Federal Reserve tightens monetary policy.

Unfortunately, the Fed's action to reduce the money supply (or publicly discuss it, "jawboning") acts as a double-edged sword sending shocks through the financial system and markets plunging. Since the start of 2022, Major World Indices and emerging alternative assets (see crypto) look weak and have experienced a significant decline in total market capitalization. Real Estate is also starting to show signs of slowing down, but gold is holding its own, even up a few points through June.

The US economy shrank 1.6% in Q1, and we anticipate the second quarter (numbers released later this month) will see further declines. At this point, the National Bureau of Economic Research (NBER) can officially trot out the appropriate labels that accurately describe the current state of our economy. Not that we needed an economist to tell us we're entering a recession (and have already been in one), it'll just now be official.

We also want to mention that fuel and energy prices are creating short-term inflationary pressure. Oil is the engine that powers our economy, and high oil prices push consumer prices up across the board. But cheap gas is a politically favorable move for both parties, and we're hopeful domestic production will expand again to provide better relief at the pump. Some analysts discuss demand "destruction", i.e., Americans driving less, as the path to falling prices but this is unrealistic outside of a steep economic recession. That's a painful outcome we'd prefer to avoid.

Our Response

Living expenses continue increasing, and more people are picking up side-hustles to make ends meet. While we hope it doesn't come to that for our readers, it seems to be a growing reality for many. While you're here, please check out our article with practical advice for weathering inflation, which seems more relevant than ever.

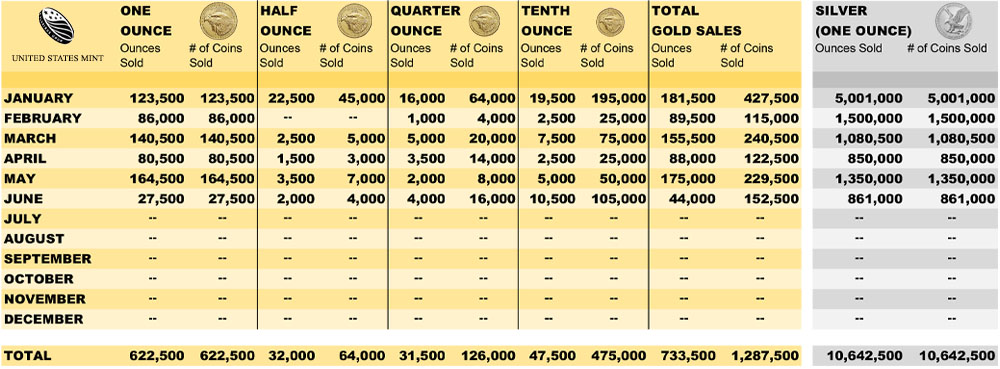

In the wake of red-hot inflation prints, starting in January with 7.5% (and most recently hitting 8.6% in June), astute individuals have increased their focus on precious metals, and the overall market observed healthy demand year to date. We've leveled off temporarily, but looking back at the first six months of American Eagle bullion production paints a clear picture. Even with some hiccups at the US Mint sales have been incredibly strong.

Year to date, American Gold Eagle sales increased 34.6% over 2021 through the same month. This demand demonstrates the faith the public places in the metals. At this point, the general public isn't oblivious, and people expect and prepare for the worst.

Key Takeaways

Ultimately, the number of US Dollars sloshing around the system (and the relatively cheap cost of borrowing) is the main culprit driving higher consumer prices. For now, the Fed appears to be shifting towards a tighter monetary policy. Still, it'll be interesting to see how they balance taming generationally high inflation figures with keeping the economy out of a full-blown depression.

In the wake of this market downturn, a positive takeaway is an ever-increasing awareness surrounding alternative assets and the need to achieve true portfolio diversity. We're always talking to new precious metals enthusiasts who clearly understand that the traditional 60/40 portfolio strategy is outdated and needs retooling.

Now more than ever, gold and silver have a spot in everyone's home. Our clients are taking positive steps to protect their hard-earned savings with tangible, safe-haven assets that offer a multi-millennia track record of stability and trust. At PIMBEX, we are committed to offering our customers the lowest possible prices on all their gold and silver purchases. And remember, it's never too late to start. Reach out today!