In a world of financial uncertainties, investing in gold and silver bullion is a time-tested wealth preservation strategy, and it's growing in popularity. These assets have stood the test of time, serving to combat inflation, currency devaluation, and market volatility. While the forces that govern the prices of gold and silver are complex and often opaque, we know that prevailing interest rates strongly affect the overall direction of the bullion market.

For those new to the precious metals scene, understanding how interest rates shape the value of gold and silver is a must. Interest rates, which are initially determined by central banks like the Federal Reserve ("The Fed"), influence not just the economy at large but also bullion price movements. This analysis aims to demystify the relationship between interest rates and gold and silver prices, offering investors a compass to navigate the investment landscape of physical precious metals.

Understanding Interest Rates

Interest rates are pivotal in determining the cost of borrowing money, and the starting point for determining these rates is the “Federal Funds Rate.” The Federal Reserve sets the Federal Funds Rate, which becomes the interest rate floor for newly borrowed money on a go forward basis. These rates influence everything from your mortgage payments to the returns on savings accounts and investments. Understanding interest rates and their impact on the economy is crucial for investors, especially those eyeing gold and silver bullion.

Interest rates are more than just the rate your bank charges for lending money; they're also powerful economic tools central banks use to control monetary policy and stimulate or cool down the economy. A hike in interest rates makes borrowing money more expensive, slowing down spending and investment. Conversely, lowering interest rates makes borrowing money cheaper and thus encourages spending and investment.

For the typical Wall Street analyst, interest rates serve as an indicator, guiding investment decisions across various asset classes. They are especially relevant for gold and silver investment decisions because precious metals do not offer interest or dividend payments. Instead, their attraction lies in their inherent value and historical role as a tangible store of wealth and a hedge against economic instability.

The Relationship Between Interest Rates and Bullion Prices

The dance between interest rates and gold and silver bullion prices is intricate and revealing. As interest rates rise, the cost of holding onto non-yielding assets like gold and silver—those that do not offer interest or dividends—becomes higher. This is due to the opportunity cost associated with these investments; the money tied up in gold and silver bullion could otherwise earn interest in savings accounts or other interest-bearing investments. As a result, when interest rates climb, the allure of gold and silver may diminish, leading to a decrease in demand and prices.

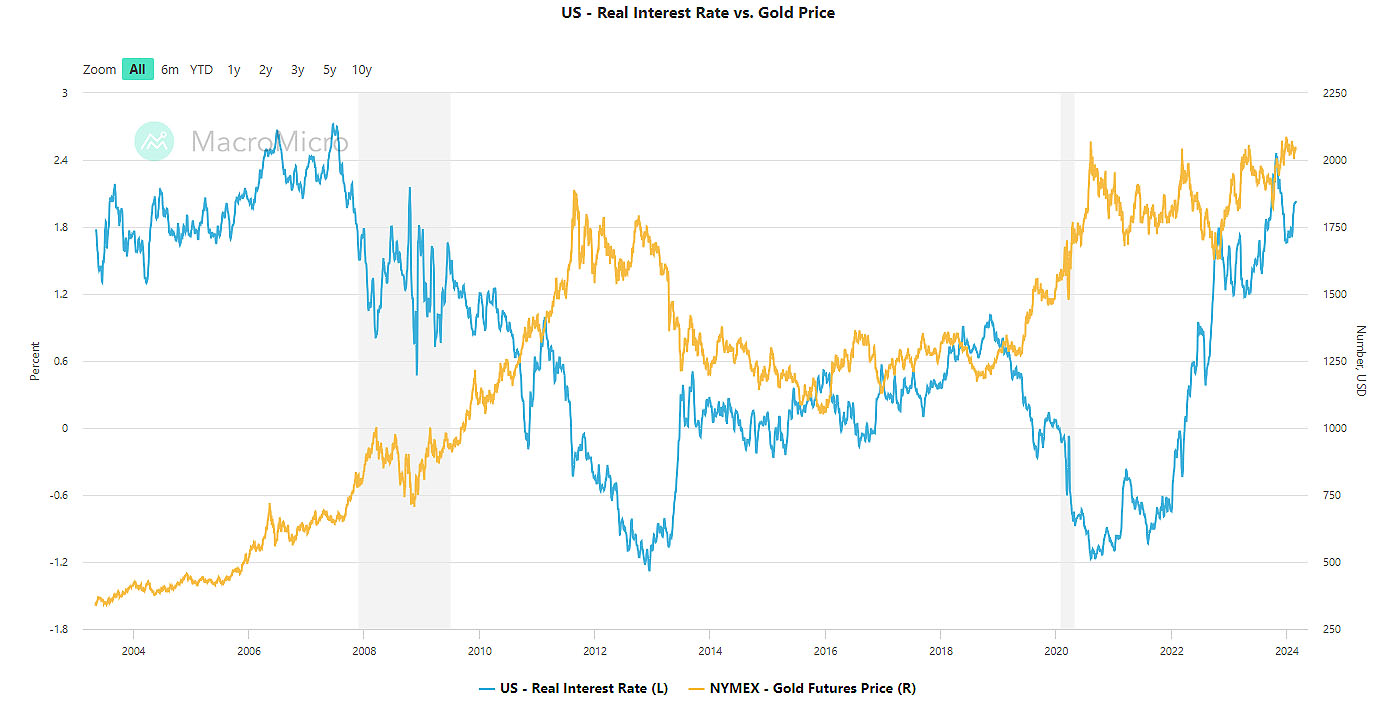

Conversely, in a low-interest-rate environment, the opportunity cost of investing in gold and silver bullion is reduced. This scenario often leads investors to seek refuge in these precious metals, considering them attractive safe havens against economic uncertainties and low returns on other, more traditional investments. Thus, when interest rates are low, the demand for gold and silver typically increases, pushing their prices upward. Historical trends have demonstrated this inverse relationship repeatedly; see the chart above.

Yet, it's essential to understand that while interest rates significantly influence bullion prices, they are not the sole determinant. A myriad of factors, including geopolitical tensions, inflation expectations, and currency value fluctuations, also play pivotal roles in shaping the market dynamics of gold and silver.

Other Factors Influencing Bullion Prices

While interest rates undeniably play a critical role in determining the price of gold and silver bullion, several other factors also significantly influence these precious metals. Understanding these elements can give investors a more nuanced perspective of the bullion market.

Inflation: Gold and silver are historically considered hedges against inflation. As the cost of living continues to increase, the purchasing power of fiat currencies diminishes. In contrast, tangible gold and silver, which cannot be printed out of thin air, often see a price increase as investors turn to them to preserve their purchasing power.

US Dollar Strength: The value of the US dollar holds an inverse relationship with gold and silver prices. When the dollar strengthens against other currencies, gold and silver, priced in dollars, become more expensive for foreign investors, potentially leading to decreased demand and lower prices. Conversely, a weaker dollar can make gold and silver more attractive, increasing demand and pushing prices up.

Geopolitical Uncertainty: Gold and silver are generally considered "safe haven" assets during times of geopolitical instability. When political or economic uncertainties arise, investors may flock to gold and silver, driving up their prices as they seek stability in tangible assets.

Supply and Demand Dynamics: The fundamental economic principle of supply and demand also impacts bullion prices. Changes in mining output, recycling rates, and industrial demand for gold and silver can all influence their market value.

By keeping an eye on these factors, in addition to interest rate trends, investors can gain a more comprehensive understanding of the forces at play in the gold and silver markets.

Conclusion

As we've explored, there is a clear inverse correlation between interest rates and gold and silver bullion prices. While interest rates wield considerable influence over the investment appeal of gold and silver, they are but one of many factors that determine these precious metals' market value.

For individuals embarking on the journey of investing in gold and silver, the path is paved with opportunities for safeguarding wealth against economic uncertainties. However, it requires a blend of strategic thinking, market awareness, and a commitment to understanding the broader economic indicators that drive the commodities.

By integrating gold and silver into a diversified investment portfolio, mindful of the myriad factors influencing their prices, investors can confidently navigate the ebbs and flows of the market. The journey of stacking gold and silver bullion is not just about seeking financial returns but about understanding the global economic landscape and securing a piece of enduring value.

And while you are here, we encourage you to shop our trusted selection today.