Never put all your eggs in one basket! Hedge your bets! Diversify your portfolio!

These principles are sound investment advice we’ve heard countless times over the years. We hear them so often that some have become cliché or begin to lose meaning. But you’re here today browsing our popular gold and silver selection, so clearly, something hit home.

Buying safe-haven assets like physical gold and silver represent an alternative approach to traditional investing. Understanding the risks of leaving our entire investment portfolio in the modern financial system is critical. We are taking deliberate steps to protect the future purchasing power of our hard-earned savings.

But knowing the best time to buy gold and silver, or what constitutes a fair price, frees us from inaction and allows us to make informed decisions. In addition, the false notion that gold or silver bullion becomes “locked away forever” might be discouraging altogether.

Luckily, a metric exists that helps investors with these decisions and can even be employed to acquire more gold (or silver) with the metal we already hold.

Enter the Gold Silver Ratio.

What is the Gold Silver Ratio?

The Gold Silver Ratio (“GSR”) is a metric that measures the ounces of pure silver required to purchase a single ounce of pure gold.

The Gold Silver Ratio provides valuable insight for precious metals investors, such as buying opportunities and even advantageous times to trade one metal into the other (typically silver into gold).

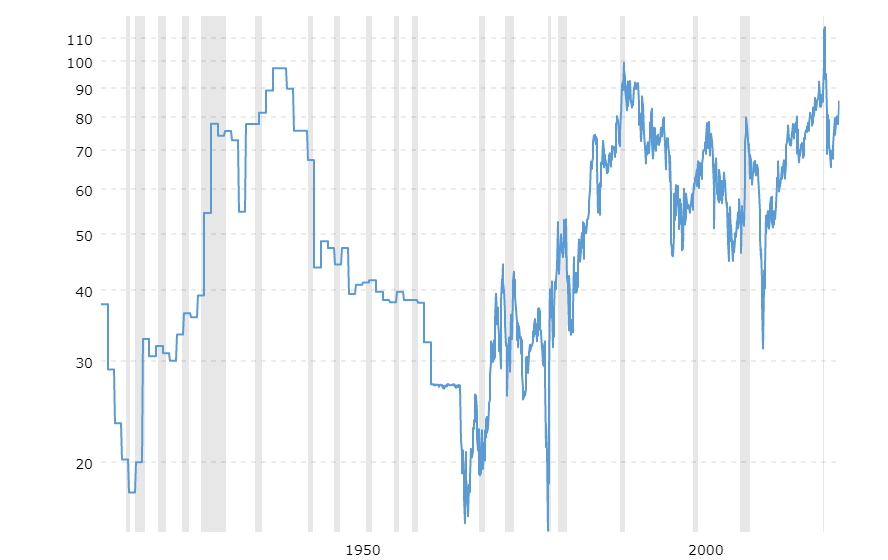

Over the past several decades, the Gold Silver Ratio fluctuated between 16 and 125 at the extremes. A lower GSR represents an excellent opportunity to sell silver (or trade silver into gold), whereas a higher GSR is generally seen as a silver buying opportunity. From that perspective, it’s a fairly straightforward concept.

By studying history and following the pattern mentioned above, savvy gold and silver buyers have used the Gold Silver Ratio to increase their metals holdings without putting extra dollars into the equation!

Investors bullish on silver price long for the day the Gold Silver Ratio returns to historical figures.

Let’s take a look back in time.

Historical Gold Silver Ratio

Historically the price of gold and silver were held much closer, usually by law, leading to a narrower ratio than we observe today. For example, the Roman Empire decided gold and silver should convert at a 12:1 ratio, and at one point, the Egyptians set the ratio as low as 1:1!

Powerful nations felt it was necessary to dictate the Gold Silver Ratio based on either the perceived scarcity of each precious metal or the relative number of coins the national mint produced. As a nod to this lost practice, the GSR is sometimes referred to as the “mint ratio.”

In 1792, Congress enacted a 15:1 conversion ratio that put the United States on a bimetallic standard until 1873. From 1873 onward, the US (and the rest of the world) operated on a de facto gold standard, and silver prices floated against a fixed gold price of around $20/oz. Gold prices were officially reset to $35/oz in 1933, and later in 1971, the gold standard formally ended with gold prices now set by open markets.

The precious metals rallies of 1980 and 2011 brought the Gold Silver Ratio to its lowest points in recent history, approximately 16 and 31, respectively. Although, those levels were only briefly visited as the GSR averages well over 60.

What Might Cause a Realignment in the Gold Silver Ratio

A return to historical levels of a Gold Silver Ratio is always possible but would require further increases in total demand for the monetary metals. Gold already observes such steady demand from institutional and retail forces that silver would require even more robust industrial demand.

A “green revolution”, which seems inevitable at this point, could be that driver. With many technological advancements that require silver, this is the logical outcome but is slower moving than some silver investors prefer.

Market analysts have also pointed to the current gold to silver mining ratio of 8:1 as the natural ratio. The Gold Silver Ratio narrowing to this level would represent a massive windfall for silver investors. It’s interesting to wonder what that might look like, but we’re not holding our breath.

We must also remember that for most of history, a low Gold Silver Ratio was accomplished under a government-enforced exchange rate between gold and silver bullion. Only in modern times has the GSR been a completely free-floating exchange rate that found equilibrium through an open market.

How to Capitalize on the Modern Gold Silver Ratio

The best way to take advantage of the Gold Silver Ratio is to understand the behavior of the two precious metals in relation to one another.

Even though the value of gold and silver fluctuate independently, similar market forces tend to sway each metal in a correlated fashion. Said another way, silver tends to follow gold price trends. With that in mind, there is a play between gold and silver as the ratio narrows and widens.

And because silver is more affordable per ounce, playing the Gold Silver Ratio is a strategy that simultaneously divests a decided portion of your hard-earned savings away from the current financial system while allowing for strategic conversions into gold when the ratio is beneficial.

Many folks utilize a dollar-cost average strategy to accumulate silver over time methodically. This wisely removes the human element from the equation that can cause inaction. Additionally, retail silver inventory is much tighter than most people realize, making it tricky to time the market effectively.

When spot price makes dramatic moves, retailers quickly sell out of inventory. Anyone who purchased silver (or at least tried) in the early stages of the Covid-19 pandemic, or the Silver Squeeze in 2021, knows this first hand.

Gold is typically much slower to sell out due to its higher cost per ounce. Thus, owning some physical silver allows you to participate in this strategy if the transaction makes sense. In this way, an investor can successfully increase their gold portfolio with metal they already own and without reaching for their checkbook again.

When you feel the time is right, this strategy is accomplished through either a local coin shop or an online dealer. Using a local shop offers convenience and allows for a direct handoff, but definitely call around for multiple quotes. If local is not an option, PIMBEX is always happy to assist with this conversion, and we guarantee top dollar on all buybacks.

Key Takeaways

The Gold Silver Ratio can assist precious metals buyers in managing their investment allocations into the monetary metals. Suppose they feel silver is particularly undervalued at the moment due to a high GSR. In that case, they may decide to focus more dollars on silver or vice versa under a low GSR environment.

Conversely, many gold and silver investors are rightfully content just parking some dollars into something tangible because that's the entire point at the end of the day. Gold and silver bullion have a proven track record and offer a unique type of diversification to anyone's investment portfolio.

In the meantime, check out our helpful price tracker and subscribe to our newsletter to stay up to date with the latest news and deals.